Содержание страницы

Coincheck Overview

Let’s start this review with some key facts about the exchange.

What is Coincheck? Coincheck is another cryptocurrency exchange and at the same time, a Bitcoin wallet service located in Tokyo, Japan. It was founded back in 2012 under the name Lejupress Ltd., and two years later, in August 2014, Coincheck service started.

The platform is currently a member of the Japan Blockchain Association, and as of April 2018, it is a subsidiary owned 100% by Monex Group, Inc. As of March 31, 2019, Coincheck has 168 employees and a capital of 100 million Japanese Yen. The founders are Koichiro Wada and Yusuke Otsuka. It is a centralized cryptocurrency exchange.

Searching for the trading volume of Coincheck on the CoinGecko website, we can see that the 24-hours trading volume as of Nov. 22, 2019, is $17,157,862 and the most active pair is BTC/JPY.

In September 2019, Coincheck announced a business partnership with Macromill Group, which is a marketing research company, also based in Japan with the purpose of launching the Coincheck Survey service. With this service, the customers of Coincheck will be able to exchange some reward points earned for digital assets.

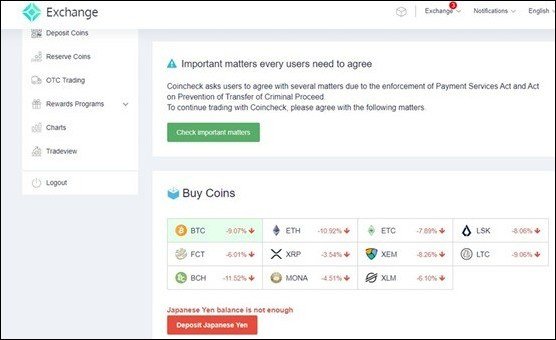

The platform is available for international users. There are only 11 coins available to trade. These are BTC, FCT, BCH, ETH, XRP, MONA, ETC, XEM, XLM, LSK, and LTC. This list of submitted assets to trade is considered a limited one, as other cryptocurrency exchanges offer over fifty coins.

Coincheck Features

Next in our Coincheck review, we should tell about the main features of the exchange, the specifications, and the main advantages of using this platform. Some of the benefits of the platform are the following ones:

– The platform is user-friendly and has a simple layout which is easy to use;

– Block trades are supported, and they are available at some favorable rates for large transactions;

– There are no delays for transferring or depositing funds;

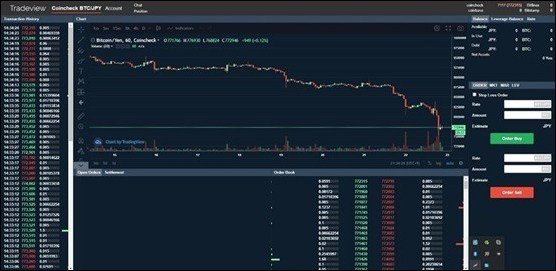

– Ability to use Trade View trading platform to trade professionally;

– Leveraged trading up to 5 times is available.

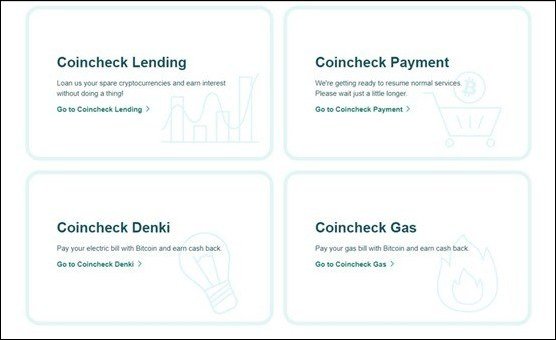

There are a mobile app and API as well as several exciting services, like Coincheck Lending, Coincheck Payment, and Coincheck Denki.

Using Coincheck Denki, the users can pay their electric bills with Bitcoin, and for doing so as a reward, they can earn cashback. The same applies to Coincheck Gas; users can pay their gas using Bitcoin and get extra money back.

It is an innovative idea and an exciting way for marketing and business purposes of attracting new users. With Coincheck Lending, users and traders can lend their cryptocurrencies and earn interest for that. If you are an investor for the long-term period, this idea seems an interesting one for earning extra income.

What Are the Available Deposit and Payment Methods?

Users can fund their accounts on Coincheck either by bank transfer or using debit and credit cards with fiat currency. There is also the option to transfer digital assets and coins from other cryptocurrency exchanges or platforms. It is important to note that prices are denominated in yen being the base currency, and there may exist differences in the actual amounts transferred and received. For withdrawals, there are the options of a direct bank account deposit or a credit card.

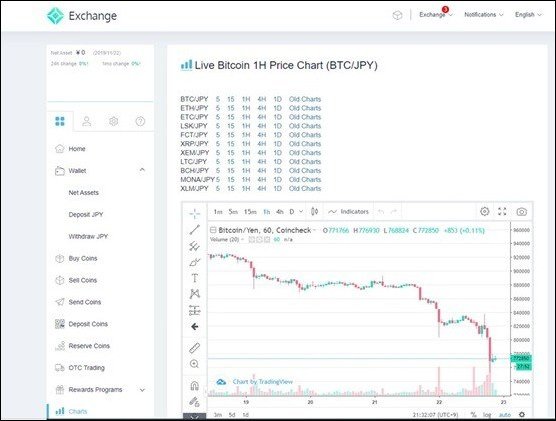

For the exchange trading tools and possibilities, there are two options. The first option is to click on the Charts tab and then trade various coins using a chart provided by Trading View.

The second option about trading is to click on the Tradeview button just below the charts button and trade professionally with may more advanced options.

This option is more sophisticated, but for basic needs and charting tools, even the first option, using the Charts provided, should be enough. Information such as the Order book is provided with the Tradeview trading tools. Although the direct Tradeview charts are much more sophisticated, the extra information provided and types of orders such as limit, or market orders, placing stop-loss orders are a better choice to trade more efficiently.

Coincheck Fees

What are the various Coincheck fees? We will mention both Coincheck withdrawal fees and Coincheck deposit fees and trading fees.

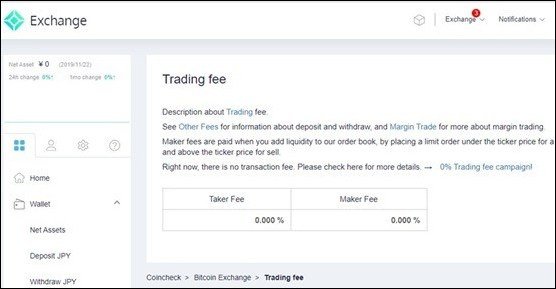

Let’s start with trading fees. There is some excellent news as currently, there is no transaction fee.

Both the Taker fee and the Maker fee are zero. The website even features a link redirecting to the Zero Trading Fee campaign page.

A lot of emphasis on Coincheck Japan.

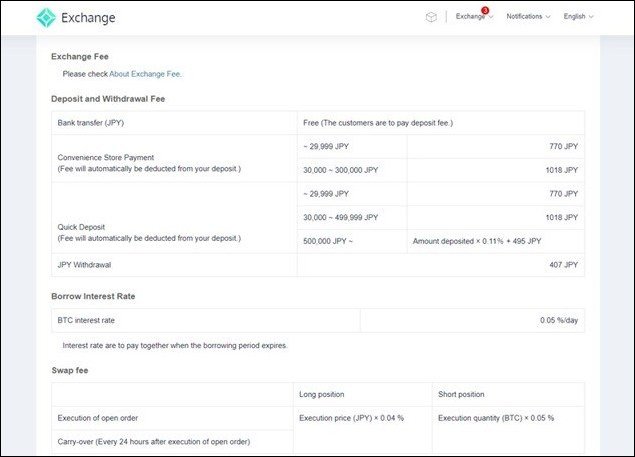

Other deposit and withdrawals fees are explained with a lot of details, but in general, these types of fees are somewhat complicated.

For bank transfers in Japanese yen, there is no fee. For a convenience store payment and quick deposits, fees are depending on the amount of capital. They can range from 770 Japanese Yen to an amount charged multiplied by 0.11% if the capital is above half a million Japanese Yen plus 495 Japanese Yen. For withdrawals in the local currency, the fee is 407 Japanese Yen.

The borrow interest rate for BTC is 0.05 %/day. There are also swap fees, which are different for long and short positions. There is a note that they calculate each swap fee separately. The list of fees continues with virtual currency fees. The virtual currency deposit fees for a reasonable deposit are free. But for the virtual currency transfer fees, each coin has its fee.

For BTC, the fee is 0.001 BTC. For ETH, the fee is 0.01 ETH. For XRP, the fee is 0.15 XRP. For XEM, the fee is 0.5 XEM. Another free fee is the one remittance fee between users of Coincheck.

Coincheck API

There is a page explaining details about Coincheck API. There is a public API and a private API. The primary category is Bitcoin. The private API’s main use is for browsing the order status and order book. The private API can place orders, either create orders or cancel them and can also check the current balance of your account.

How to Use the Exchange?

What are the Exchange KYC and verification process? Two options are available for signing up either as a person or as a corporate account. You can create an account with Facebook or an email address.

The identity verification process requires both an SMS authentication and document verification. The necessary documents are the passport and the driver’s license, the typical documents used for verification by other cryptocurrency exchanges and platforms. If you choose to sign up for a corporate account, then the verification process is somehow different as the legal entities or companies must provide a selfie of an executive holding his/her identity in hand.

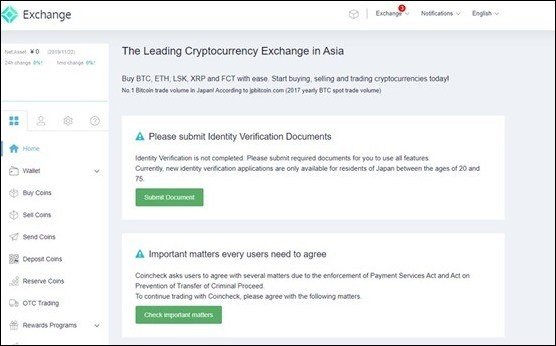

It is essential to submit all required documents and complete the identity verification process to be able to use all services.

Furthermore, Coindesk places a lot of emphasis on several safety issues, such as the Act on Prevention of Transfer of Criminal Proceeds but also the Payment Services Act.

Users must agree with these matters checking and confirming with an extensive list of files such as Private Policy, Electronic Delivery Agreement, Terms of Use, Trading manual, and last but not least the statement that you are not a politically exposed person and not a current member of any criminal organization.

Once users have read carefully and checked their agreement with all these critical matters, then they can start using the platform. You can deposit fiat currency, Japanese Yen to a registered bank account with the Coincheck exchange, and after they are credited, you can start trading. You can also use credit cards to deposit money and start buying and selling coins.

How to buy on the exchange, and what is the trading process? The answer is simple; you have the option to click on several buttons such as buy coins, sell coins, send coins, deposit coins, or reserve coins. You have the option to choose the available coins, set the amount you want and choose the original currency with two options, BTC or JPY.

To deposit coins, each coin has different confirmations required. Bitcoin has three confirmations required, and Ethereum 36 confirmations required. The trading process, if you choose to trade with the Tradeview, more advanced platform is pleasant, with many indicators to choose from to apply technical analysis.

There is also the option of OTC trading. For withdrawals, you can withdraw the Japanese Yen by bank transfer, and it is required to have completed the identity verification process.

Customer Service

Next, in this Coincheck review, we will mention the support team, the exchange reputation, and reviews and some common user problems. One of the most common user problems is that pages are written in Japanese, and unless you have the potential to translate the page automatically, it is hard to get the information required. Unless you know Japanese.

There is a communication form, and you can submit a ticket as well. The customer support is only available during business hours and weekdays from 10 AM until 6 PM. If there are many inquiries, the time to respond may take longer, and this is not specified. Visiting the site CryptoCompare.com the reviews of Coincheck show an average score of 2.9 out of 5 stars, but the sample is tiny, only 22 reviews.

FAQ

Some frequently asked questions about the exchange are how to create security copies of the account and what is the time to withdraw the Japanese Yen. The answers are that you can create a secret key with a two-step verification following some steps explained, and it takes about two business days to withdraw the Japanese Yen.

Is Coincheck Safe?

There are many searches online about terms such as “Coincheck hack”, “is Coincheck safe” and “Coincheck scam”. And plenty of Coincheck reviews. In January 2018, there was a massive case of Coincheck hack for a substantial amount of capital, 530 million US dollars. At that time, the exchange was not registered with the Financial Services Agency in Japan, the local financial regulator.

However, Coincheck decided to refund all users who, unfortunately, got affected by this hack. In early 2019 the exchange got a cryptocurrency exchange license to operate from the Financial Services Agency. So, the answer to the question is Coincheck safe is hard to answer.

The recent event with the hack is not good for Coincheck reputation. But taking into consideration the official license by the financial regulator means that there are stringent regulatory measures that are now applied.

This official license is one of the main reasons encouraging people to use Coincheck exchange. Safety rules, risk management controls, governance procedures are now followed, providing a significant degree of customer protection.

Conclusion

Our Coincheck review focused on several topics, such as the platform itself, and the various exciting services offered. The platform is easy to use, with plenty of information such as service guides, multiple policies, a more advanced trading solution using Tradeview charts.

There was a recent incident with the exchange being hacked with a tremendous amount of money. Still, ever since, things have changed a lot, and Coincheck is now officially registered and regulated by the local financial regulator. The unique services offered, such as paying several utility bills with Bitcoin and get rewarded for doing so, is an exciting feature.

There are several campaigns and rewards programs running, and this can be another reason to try this exchange.